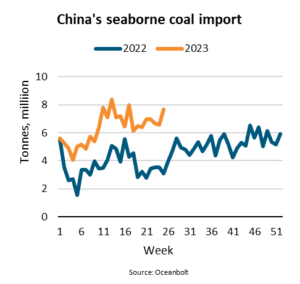

“Despite China’s strategy of pursuing increased domestic coal production, which has meant that year-to-date production stands 5.8% higher than last year, its seaborne imports of coal have nevertheless surged 73% y/y so far,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

The Chinese government target for domestic coal production is 4.6 billion tonnes in 2025, which is 2.5% higher than in 2022. As production year-to-date has already increased by 5.8% compared

to 2022, Chinese coal mines will likely hit that target this year.

“Domestic coal supply has faced stiff competition from seaborne coal imports due to price and quality. In addition, coal imports from Mongolia have increased five-fold compared to last

year,” says Rasmussen.

According to the Centre for Research on Energy and Clean Air (CREA), the production price index (PPI) for coal mining and coal washing increased by 45% and 17% in respectively 2021 and 2022.

At the same time, to fulfil output targets, mine operators have prioritised quantity over quality – something a China Electricity Council official identified as a problem of “clear decline in coal quality” in January.

In recent years, imported coal has accounted for 7-8% of total coal supply in China. Combined, the increases in imports and in domestic mining have so far raised total coal supply in China

by over 15% y/y. Electricity production from fossil fuels (mainly coal) has grown 5.8% y/y while steel production is up 2.8% y/y.

“The gap between supply and demand increases led to coal stocks at Chinese power plants reaching a record high of 187 million tonnes in May, more than total year-to-date seaborne imports,”

says Rasmussen.

Shipments from Indonesia have accounted for nearly half of the increase in seaborne imports, while Russia and Australia together contributed the other half. Capesizes have benefitted the

most, as their coal volumes to China have nearly doubled due to the volumes from Russia and Australia. However, all size segments have enjoyed increased support from coal shipments into China.

“While it remains to be seen whether China will continue to build coal stocks, it seems more likely that coal supply will have to adjust to the lower coal demand. As coal has accounted

for three quarters of the increase in China’s dry bulk imports year-to-date, the market will be hoping that imports continue to be prioritised,” says Rasmussen.